Sale!

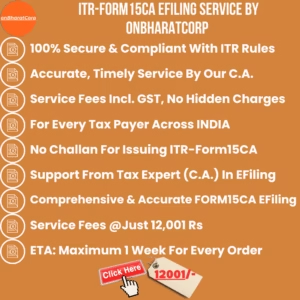

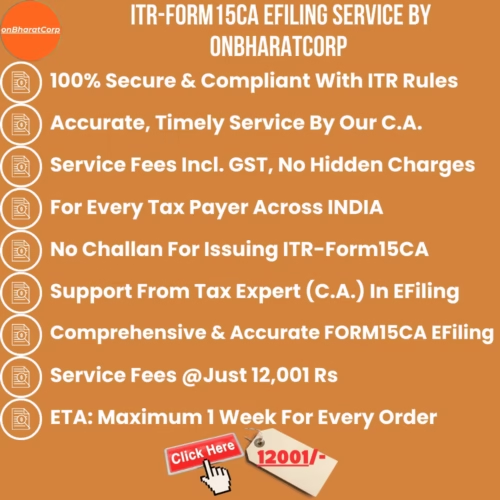

101935-ITR-Form-15CA EFiling Service Details

Original price was: ₹24,001.00.₹12,001.00Current price is: ₹12,001.00.

ITR-EFiling Form-15CA Service

Only logged in customers who have purchased this product may leave a review.

Original price was: ₹24,001.00.₹12,001.00Current price is: ₹12,001.00.

ITR-EFiling Form-15CA Service

Only logged in customers who have purchased this product may leave a review.

101935-ITR-Form-15CA EFiling Service Details

101935-ITR-Form-15CA EFiling Service Details

Reviews

There are no reviews yet.