Documents required to reply to an Income Tax Notice

The documents are required to vary according to the type of income tax notice that is served to the taxpayer. The basic documents needed to reply to an income tax notice would be:

1. The Income Tax Notice copy.

2. Proof of Income source such as (Part B ) of Form 16, Salary receipts, etc.

3. TDS certificates, Form 16 (Part A)

4. Investment Proof if they are applicable.

It is always advisable to have tax experts review the notice. Therefore, after uploading the copy of the Income Tax notice, the experts will examine it and propose the most suitable solution. Based on their advice, you can request the necessary documents. To proceed, please send a copy of the Income Tax Notice and your questions to care@onbharatcorp.com.

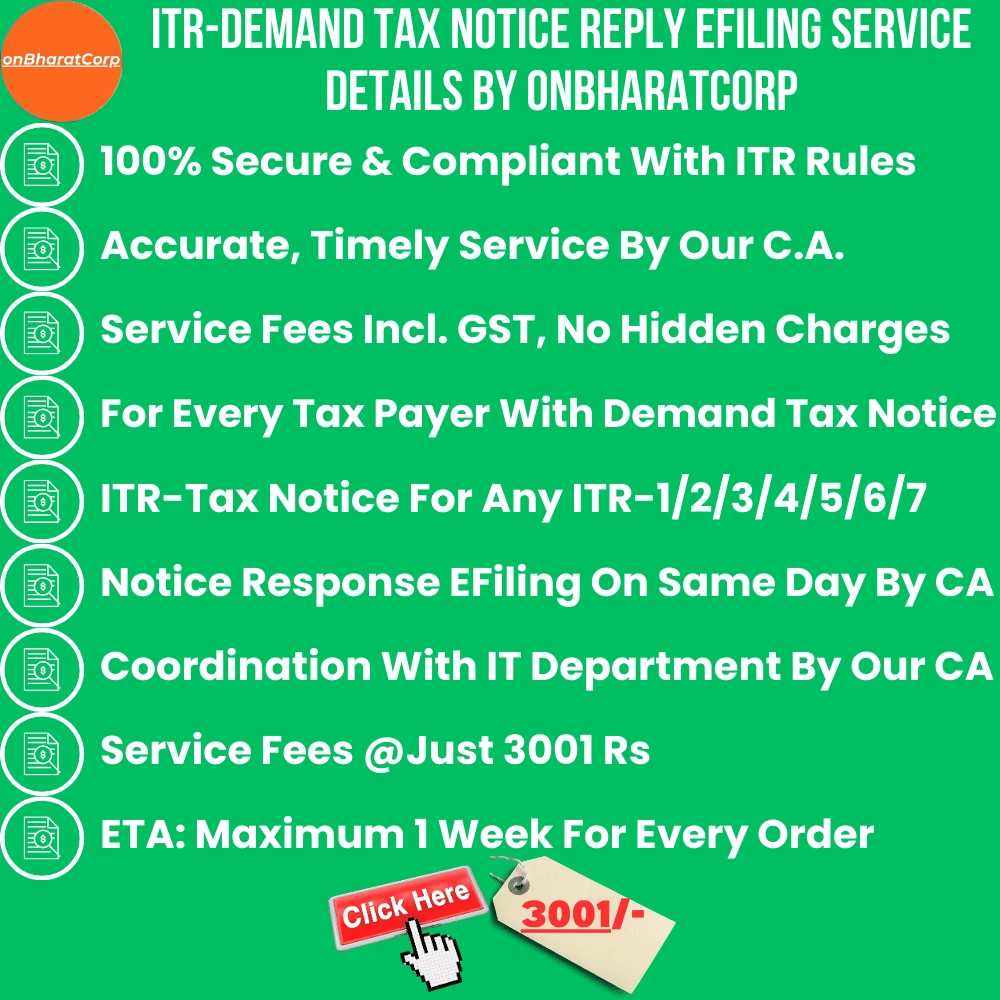

Click Here To Upload Your Documents

onBharatCorp offers comprehensive support for addressing Income Tax notices through a range of specialized services. Our team provides tailored consultations with seasoned tax professionals who can offer insights specific to your situation. We conduct a thorough analysis of the notice to clarify its details and requirements, ensuring you fully understand what is being asked. Additionally, we assist in identifying and gathering all necessary documents to facilitate a complete and accurate response. Our experts are skilled in preparing well-crafted replies that are timely and directly address the concerns raised by the Income Tax Department. Furthermore, we prioritize compliance with tax regulations to help mitigate the risk of additional inquiries or penalties. For expert assistance in filing your response to an Income Tax notice, turn to onBharatCorp today.

The Income Tax Department issues notices for a variety of reasons, including failure to file income tax returns, errors encountered during the filing process, or situations where further documentation or information is needed. Receiving such a notice should not be a cause for alarm; rather, it is essential for the taxpayer to carefully interpret the notice, understand its implications, and identify the specific requests made by the department. Once this understanding is achieved, the taxpayer can take appropriate actions to address the requirements outlined in the notice. onBharatCorp provides a wide range of services designed to assist both individuals and businesses in ensuring compliance with tax regulations. If a notice from the Income Tax Department is received, it is advisable to reach out to a Tax Expert at onBharatCorp for guidance on how to interpret the notice and formulate an effective response.

A notice from the Income Tax Department serves as an official communication directed at a taxpayer, addressing various elements related to income tax filing and compliance. These notices may pertain to requests for further information, clarification of any discrepancies found in a tax return, audit notifications, demands for tax payments, or updates regarding refunds. Each notice is detailed, outlining precisely what the department requires from the taxpayer, which may include the submission of specific documents or explanations regarding reported income or deductions. Understanding the content and requirements of such notices is crucial for taxpayers to ensure they meet their obligations and avoid potential penalties.

Reviews

There are no reviews yet.