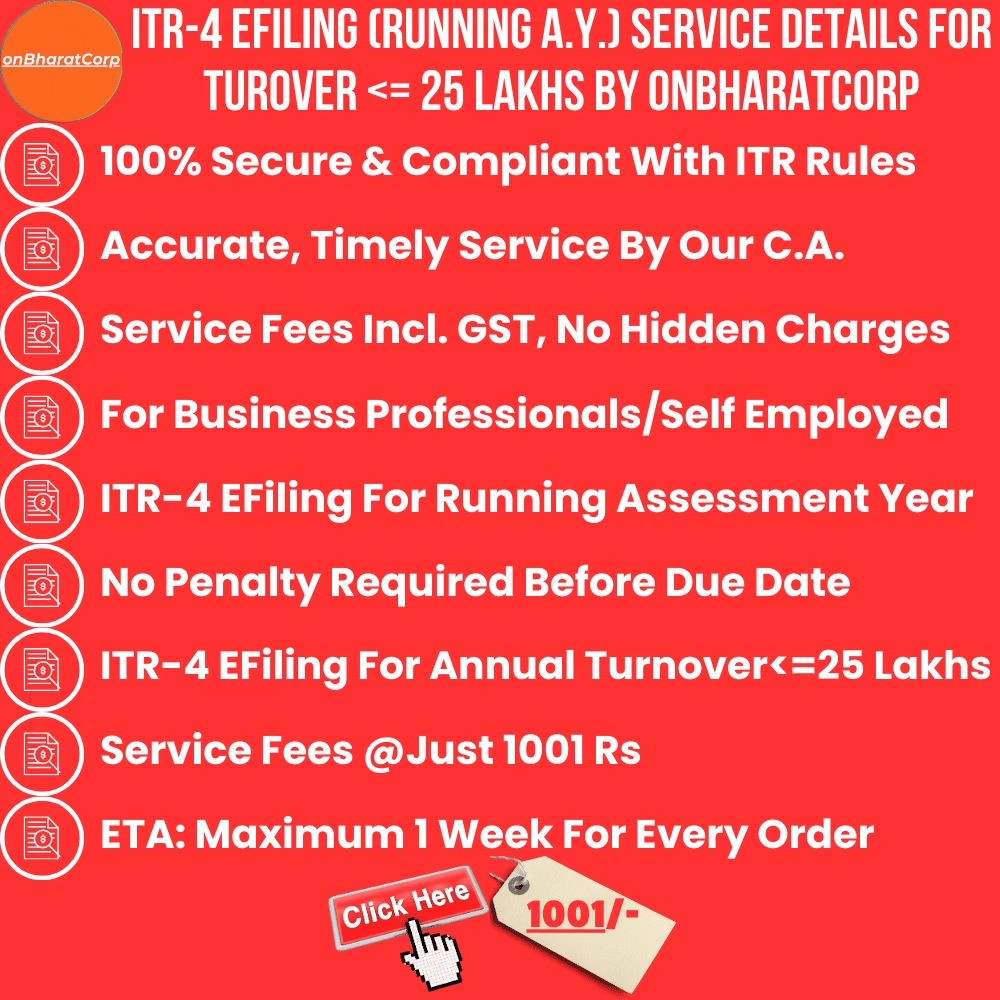

ITR-4 EFILING SERVICE (RUNNING A.Y.) DETAILS FOR TURNOVER<=25 LAKHS

The Income Tax Return Form 4 (ITR-4) in India is a simplified income tax return form designed for individuals, Hindu Undivided Families (HUFs), and firms (excluding LLPs) who opt for the Presumptive Taxation Scheme under Section 44AD, Section 44ADA, or Section 44AE of the Income Tax Act, 1961. Here’s a comprehensive guide on ITR-4:

Documents Required:

1. Bank statements.

2. Form 16 or Form 16A (TDS certificates).

3. Profit & Loss Account details (if applicable).

4. GST details (if registered under GST).

5. Proof of investments for deductions under Chapter VI-A (e.g., Section 80C, 80D).

Click Here To Upload Your Documents

Key Due Dates

Filing due date (non-audited cases): 31st July of the assessment year.

Tax audit cases (if opting out of presumptive scheme): 31st October.

Penalties for Non-Filing:

₹1,000 for income below ₹5 lakh.

₹5,000 for income above ₹5 lakh.

Interest under Section 234A: 1% per month on tax due.

Reviews

There are no reviews yet.