Click Here To Upload Your Documents

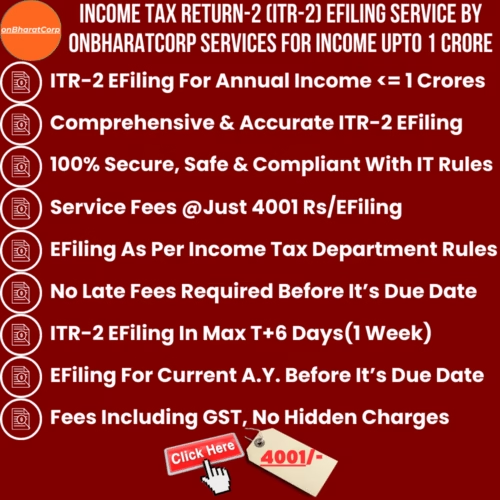

ITR-EFiling Form10E Service

Sale!

ITR EFiling Services-All Services List, ITR Miscellaneous EFiling Services

ITR-EFiling Form10E Service

Original price was: ₹6,001.00.₹3,001.00Current price is: ₹3,001.00.

ITR-EFiling Form10E Service

Documents Required for Filing Form 10E

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.