Advance Tax in India refers to the payment of income tax in installments throughout the financial year, instead of paying a lump sum at the end of the year. It is essentially a “pay-as-you-earn” tax system to reduce the year-end tax burden and ensure timely collection for the government.

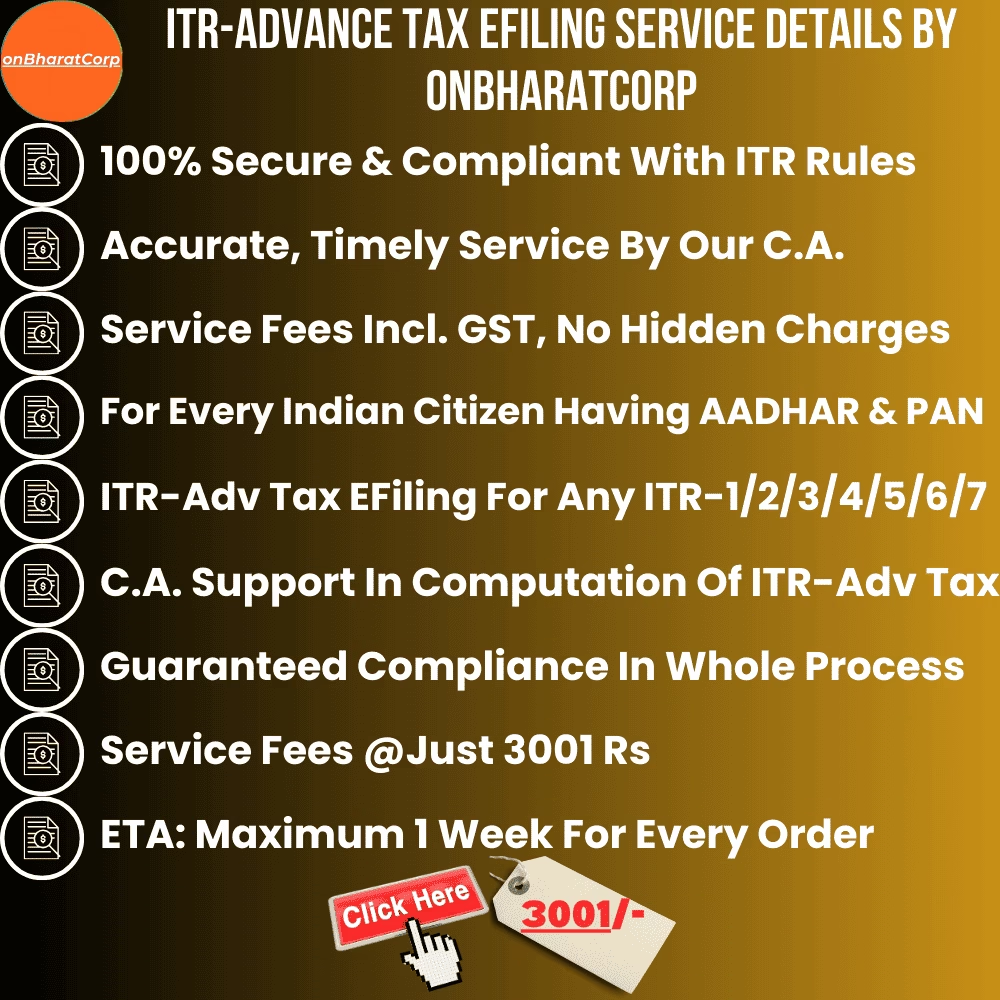

Click Here To Upload Your Documents

What is Advance Tax? Advance Tax is the tax that an individual, business, or entity needs to pay during the financial year on estimated total income if their tax liability exceeds ₹10,000 in a financial year. It applies to all types of taxpayers, including individuals, freelancers, businesses, and companies.

Who is Liable to Pay Advance Tax?

a. Applicable to:

Individuals: Salaried, self-employed, and professionals.

Businesses: Sole proprietorships, partnerships, and companies.

Freelancers: Independent contractors or gig workers with substantial income.

Taxpayers under Presumptive Taxation Scheme: Those declaring income under Sections 44AD or 44ADA.

b. Exceptions:

Senior citizens (aged 60 or above) not running a business are exempt from paying advance tax.

Taxpayers whose total tax liability is less than ₹10,000 after TDS deductions.

For Presumptive Taxation (Sections 44AD/44ADA)

Entire tax liability (100%) must be paid by 15th March of the financial year.

Reviews

There are no reviews yet.